The Income Tax Exemption No. The Real Property Gains Tax Exemption Order 2018 PU.

Sales And Service Tax Act 2018

Goods are taxable unless they are specifically listed on the sales tax exemption list.

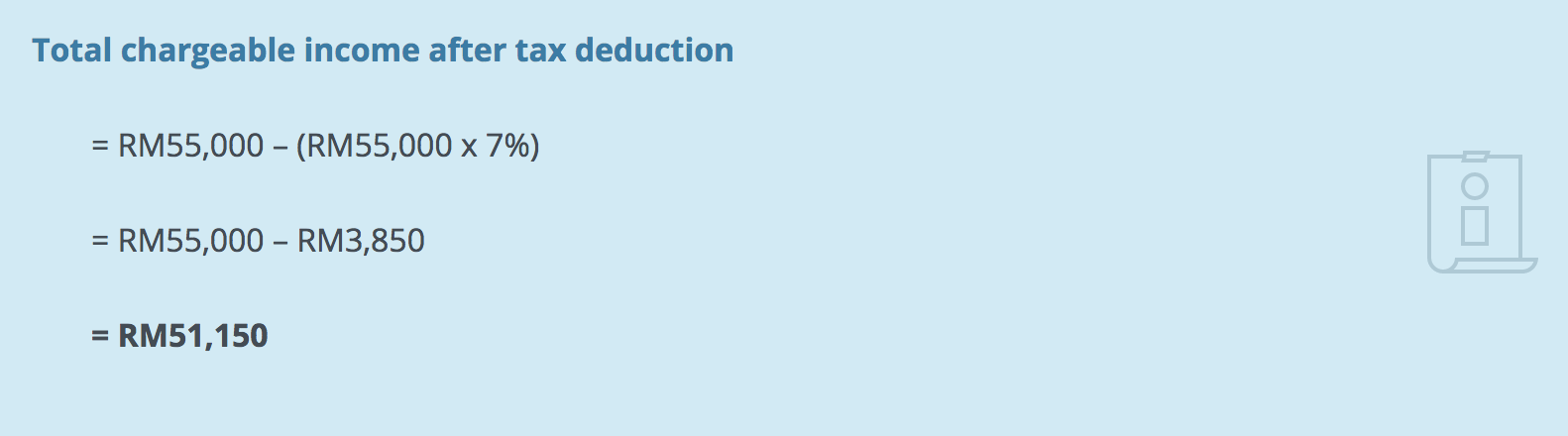

. Income tax in Malaysia is imposed on income. The government released an Exemption Order the Order on 10 April 2017 providing a temporarily reduction in corporate income tax rates based on incremental taxable income compared to the preceding year of assessment. An individual who earns an annual employment income of RM25501 after EPF deduction has to register a tax file.

For instance Jill a 38-year-old. To encourage property investment the new Budget offers a stamp duty exemption for loan agreements and. The criteria to qualify for this tax exemption are.

According to the recent RMCD Guidance a general exemption under the proposed. Applications for the exemption would have to be submitted to Talent Corporation Malaysia Berhad TalentCorp from 1 January 2018 to 31 December 2019 and the exemption would be effective for YA 2018 to 2020. Chargeable income Taxable income Tax exemptions Tax reliefs.

Following the announcement of the re-introduction of SST the Royal Malaysian Customs Department RMCD has recently announced the implementation framework of SST as well as a detailed FAQs to arm Malaysians with sufficient knowledge before SST commence. The exemption would apply only to women returning to the workforce after a career break of at least two years as of 27 October 2017. Latest exemption for Real Estate in 2018.

Real property gains tax exemption on the disposal of low-cost medium-low and affordable residential homes. Tax exemption on rental income from. No further exemption will be given for the disposal of other private residences.

14 Income remitted from outside Malaysia. Tax-filing season has begun in Malaysia and the task of trying to save money through claiming tax relief and rebates can be confusing. As an initiative to increase home-ownership for the nation the Prime Minister in the Budget 2018 has allocated RM22 billion to the housing development in Malaysia.

An additional exemption of RM8000 is available for disabled children above 18 years who are not married andor pursuing further education programs. Here are the tax rates for personal income tax in Malaysia for YA 2018. Chargeable Income RM Calculations RM Rate Tax M 0 5000.

Operating in Malaysia more than a year. On the First 5000 Next 15000. The new Sales tax will be levied on taxable goods that are imported into or manufactured in Malaysia.

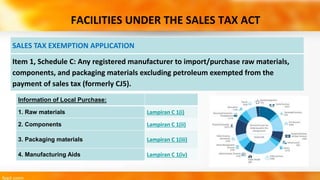

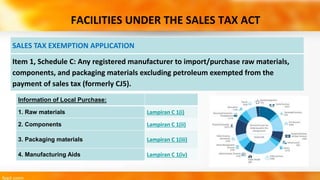

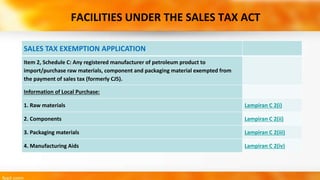

Malaysia Service Tax 2018. The government has proposed the following stamp duty exemptions for first time home-buyers. Master Exemption List MEL and the importer of such items that is petroleum upstream operator will be given an exemption from sales tax subject to prescribed conditions as stated in the Sales Tax Person Exempted from Sales Tax Order 2018.

The criteria to qualify for this tax exemption are. Section 61A STA 2018 Exemption from payment of sales tax on taxable goods imported transported or purchased from registered manufacturer. Applications for the exemption would have to be submitted to Talent Corporation Malaysia Berhad TalentCorp from 1 January 2018 to 31 December 2019 and the exemption would be effective for YA 2018 to 2020.

With the exclusion of IP income from the scope of the incentives IP income becomes fully taxable. Basically Stamp Duty in Malaysia is a tax levied on a variety of documents including legal commercial and financial documents all of which are specified in the First Schedule of Stamp Duty Act 1949. Income Exempt From Tax Double Tax Treaties and Withholding Tax Rates Real Property Gains Tax Stamp Duty Sales Tax.

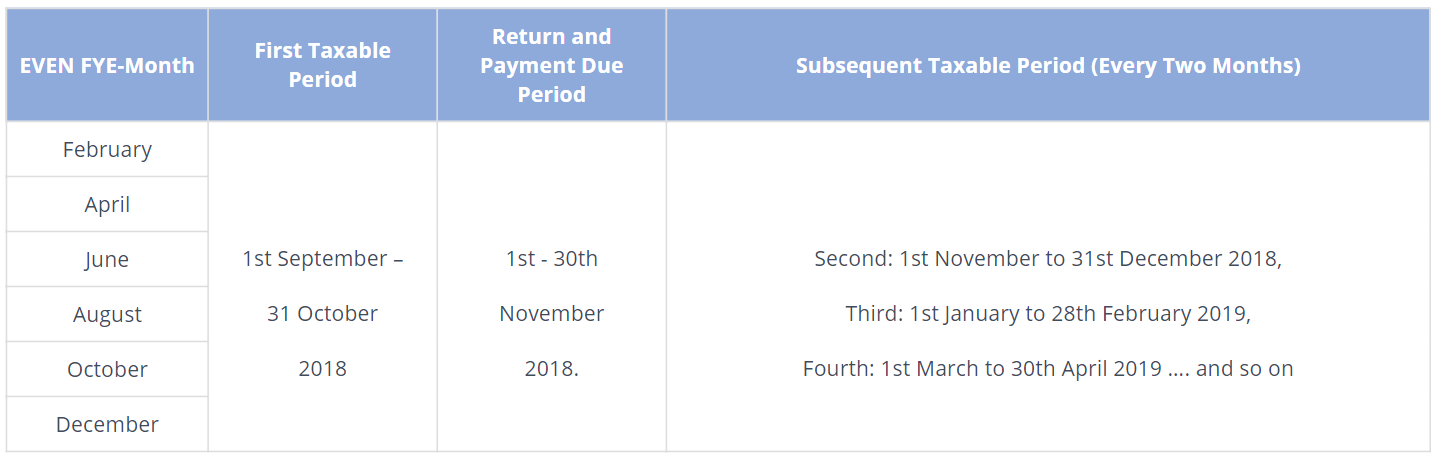

Annual turnover more than RM10M. What is the SST treatment on goods delivered after 1st September 2018 and payment. The proposed sales tax will be 5 and 10 or a specific rate for petroleum.

March 16 2018. No election can be made where an exemption has been granted to an individual under the repealed Land Speculation Tax Act 1974 in respect of the disposal of a private residence. In this regard Malaysia has passed laws by 31 December 2018 to remove IP income from the scope of various Malaysian tax incentives.

The introduction of the tax exemption will encourage and promote Malaysia as a RD centre says Nitin. For example if you take up a job while overseas and you only receive the payment for the job when you are back in. What comes as a surprise to many is the 50 tax exemption on rental income received by Malaysian resident individuals.

Section 61A STA 2018. YA 20182019 Tax RM on excess 5000 0 1 20000 150 3. The service tax will stand at 6 and it would be levied on.

What comes as a surprise to many is the 50 tax exemption on rental income received by Malaysian resident individuals. OTHERS Sales of Goods 35. Purchase of breastfeeding equipment for own use for a child aged 2 years and below Deduction allowed once in every 2 years of assessment 1000 Restricted 13.

Effective from 1 September 2018 Sales Tax Act 2018 and the Service Tax Act 2018 together with its respective subsidiary legislations are introduced to replace the Goods and Service GST Act 2014. 2 Order 2017 has effect for the year of assessment 2017 and year of assessment 2018. A 360 gazetted on 28 December 2018 provides that a Malaysian citizen individual is exempted from real property gains tax RPGT on the chargeable gain derived from the disposal.

Women entering the workforce after at least two years on a work break will be exempt from income tax for a 12-month period. As the clock ticks for personal income tax deadline in Malaysia 2018 like gainfully employed Malaysians you may have started visiting the LHDN Malaysia website to do your E-Filing as both a proactive and precautionary measure. Payment for child care fees to a registered child care centre kindergarten for a child aged 6 years and below.

As a continuation of Malaysias Vision 2020 blueprint for economic development the National Transformation TN50 initiative was introduced along with the 2017 budget to drive Malaysia to be among the top 20 nations in economic development social advancement and innovation by 2050. RM6000 plus possible additional RM8000. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax.

As an initiative to increase home-ownership for the nation the Prime Minister in the Budget 2018 has allocated RM22 billion to the housing development in Malaysia. Under the Sales Tax Act 2018 sales tax is charged and levied on imported and. Election for exemption must be made in writing and is irrevocable.

Trader of taxable goods trading goods. On the First 2500. If you want to find the answer to whether or not your RM100 monthly travel allowance is tax exempt.

Malaysia Sales Tax 2018 Malaysia Sales Tax Framework

Tax Relief For Year Of Assessment 2018 Plctaxconsultants

Goods And Person Exempted From Sales Tax Sst Malaysia

No 10 Drop In Car Prices Despite 10 Sales Tax Exemption Here S Why Wapcar

Key Highlights Of Malaysia Budget 2018

Income Tax Malaysia 2018 Mypf My

Newsletter 56 2018 Guideline On Income Tax Exemption For Religious Institution Or Organization Under Income Tax Exemption Order 2017 Page 001 Jpg

Sales And Service Tax Act 2018

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

Whatsapp Centre Islamic Relief Malaysia Islamic Relief Humanity Lifestyle Islamic Relief Islam Mobile App

Income Tax Malaysia 2018 Mypf My

Tax Exemption For Rental Income 2018 Donovan Ho

Reliefs For Personal Income Tax 2017 Vs 2016 Teh Partners

Newsletter 32 2018 Donation To Tabung Harapan Malaysia Donations Tax Exempted Page 001 Jpg

Analysing The Numbers Behind Najib S Budget 2018 Asean Today

Key Highlights Of Malaysia Budget 2018

Malaysia S 2018 Budget Salient Features Asean Business News

Malaysia Sst Sales And Service Tax A Complete Guide